Wine faces a rocky start to the year, but there’s growth if you know where to look.

After a strong close to 2024, South Africa’s wine industry has hit a challenging patch at the start of 2025. According to Vinimark’s Q1 2025 Market Review, presented by Head of Insights & Business Advisory Oelof Weideman, a combination of economic strain and shifting consumer behavior is reshaping the landscape.

Consumer confidence has taken a sharp dip, with the index falling from -6 in Q4 2024 to -20 — the lowest level in years. “That number isn’t just data,” says Weideman. “It tells us how South Africans are feeling. Right now, they’re worried. And when sentiment drops, so does spending.”

This dip in confidence persists despite modest macroeconomic improvements. The Consumer Price Index (CPI) has dropped to 2.7%, and food inflation is down to 2.5%, while GDP growth remains marginal at 0.6%. However, improvements haven’t filtered down to household level. Unemployment remains high, and the wine sector is feeling the pressure.

In the first quarter of 2025:

- Wine sales declined 2.6% in value year-on-year

- Volume dropped almost 5% for 750ml still wine

- Wine was the worst-performing liquor category

While consumers are visiting retail outlets more frequently (4.8 times/month, up from 4.4), that doesn’t necessarily equate to increased spend. Instead, it signals increased price sensitivity. “More trips don’t mean more money,” Weideman confirms. “They mean more caution — and more demand for value.”

Affordability is driving a shift in formats and price points. One-litre bottles and wines under R50 are gaining traction. However, recent price increases — such as 4th Street’s 13% hike on 5L bag-in-box wines — have led to volume declines without clear consumer migration to alternative brands like Raindance Wines. “Instead of switching, many are leaving the category altogether,” Weideman notes.

As prices cross into triple digits, the pressure intensifies: slower sell-through, heavier discounting, and greater reliance on promotions. The critical sub-R80 segment has declined 6.4%, while only the R100–R200 range has seen modest growth of 1.2%.

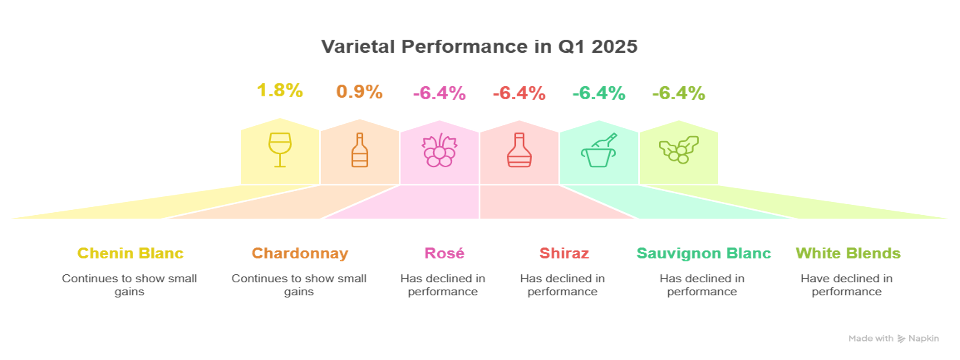

Varietal trends are equally telling. Chenin Blanc (+1.8%) and Chardonnay (+0.9%) are holding ground, while others — Rosé, Shiraz, Sauvignon Blanc, Merlot, and Pinotage — are slipping. Red blends have dropped below the 10-million-litre mark for the first time in Weideman’s experience.

Retailers are also feeling the squeeze, with only 5.5% of SKUs driving 80% of wine sales. “When consumers feel overwhelmed by too much choice, they default to what they know,” says Weideman. Smart shelf strategy and range rationalisation are becoming essential survival tools.

Not all news is grim. Chateau Del Rei’s canned sparkling wines are outperforming expectations, though likely drawing buyers from the cooler and FABs categories rather than wine loyalists. “It’s unclear if it’s the product’s wine identity, or its affordability and high sugar/alcohol content, that’s driving sales,” Weideman explains.

The on-trade is where premiumisation is showing signs of life. “People may be going out less, but when they do, they’re choosing better bottles,” Weideman observes. “It’s about making fewer occasions count more.”

The outlook? Cautious but hopeful.

“Producers and retailers who succeed in 2025 will be those who protect brand value while aligning with consumer realities — pricing smartly, communicating clearly, and staying flexible,” says Weideman. “The start of 2025 has been sobering, but South African wine has always shown resilience in the face of challenge.”

For more insights and full data access, visit: www.vinimark.co.za